Introduction

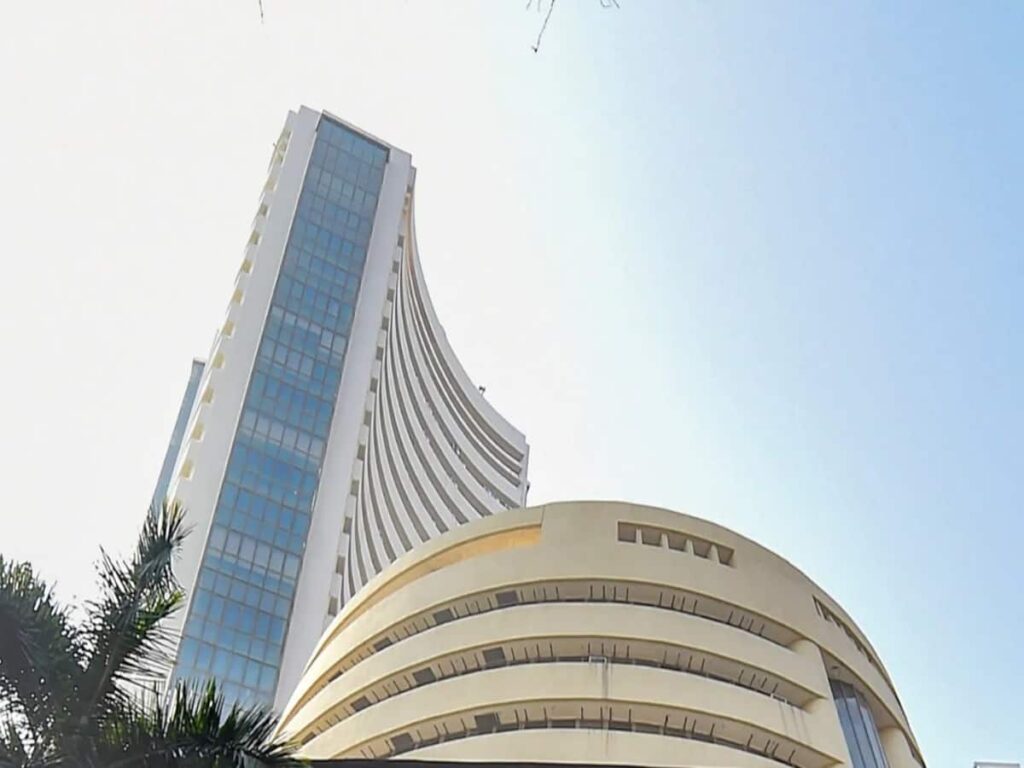

The Indian share market is known for its vibrant trading activities, but it also observes specific holidays throughout the year. Understanding these holidays is crucial for traders and investors as it impacts market operations and investment strategies. On October 2nd, both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) will observe a trading holiday. This pause in trading is essential for various reasons, including national observances and religious festivals.

Trading Holidays in October

On October 2nd, there will be no trading across all segments of BSE and NSE. This holiday coincides with the observance of Mahatma Gandhi Jayanti in India, a day commemorating the birth of Mahatma Gandhi, the father of the nation. It’s a day of reflection and remembrance, which impacts financial markets.

Recent Holidays Prior to October

Before the October holiday, significant trading breaks were observed on September 18th due to the celebration of Eid-e-Milad. Various segments of BSE and NSE were closed, impacting different sectors of the financial market. Below is a brief overview of the segments affected:

| Date | Holiday Type | BSE Segments Affected | NSE Segments Affected |

|---|---|---|---|

| September 18 | Eid-e-Milad | Currency Derivatives, NDS-RST, Tri-party Repo | Currency Derivatives, Interest Rate Derivatives, Corporate Bonds, New Debt, Negotiated Trade Reporting Platform |

| October 2 | Gandhi Jayanti | All Segments | All Segments |

Impact of Trading Holidays

Holidays in the share market can lead to various implications for investors and traders, including:

- Liquidity Constraints: The absence of trading can reduce liquidity in the market.

- Price Fluctuations: Post-holiday trading might witness significant price movements as investors adjust their positions.

- Market Sentiment: Holidays can influence investor sentiment, and trends might change after a break.

Conclusion

Understanding share market holidays is crucial for anyone involved in trading and investing in India. The upcoming trading holiday on October 2nd, alongside the prior holiday on September 18th, highlights the importance of planning trading strategies around these breaks. As markets pause for reflections and celebrations, it’s essential for traders to stay informed about when trading is halted to navigate their investments effectively.